As a college student, it can be challenging to manage your finances and stick to a budget. But don’t worry, we’ve got you covered.

In this guide, we’ll provide you with all the tips and tricks you need to take control of your finances and make the most of your college experience.

We’ll cover everything from creating a budget and finding ways to save money on textbooks and housing, to managing your money and avoiding debt.

By following the advice in this guide, you’ll be well on your way to financial success in university and beyond. So let’s get started!

Table of Contents

Creating a Budget That Works for You

It’s time to wave goodbye to the days of randomly spending money and hoping for the best. In order to take control of your finances, you’ll need to create a budget that works for you.

But don’t worry, it’s not as intimidating as it sounds. In fact, it can be kind of fun! Just grab a pen and some paper (or your favorite budgeting app) and start by listing all of your income sources, including any part-time jobs, loans, grants, or allowances.

Then, make a list of all your expenses, including tuition, rent, groceries, and any miscellaneous expenses like going out with friends. By subtracting your expenses from your income, you’ll be able to see how much money you have left over each month.

And voila! You’ve created a budget. Now all you have to do is stick to it. Easy peasy, right?

Finding Ways to Save Money on Everyday Expenses

Now that you have a budget in place, it’s time to start looking for ways to save money on your everyday expenses. One of the easiest ways to save money is to cut down on unnecessary spending.

Do you really need that daily latte from the campus coffee shop? Could you bring your own lunch to school instead of eating out every day? Every little bit counts, so take a look at your budget and see where you can cut back.

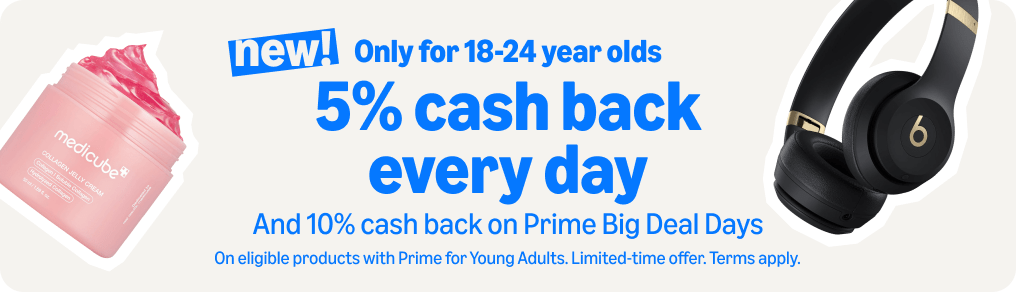

Another way to save money is to shop smart. This means comparing prices, looking for discounts and sales, and avoiding impulse purchases.

Don’t be afraid to negotiate for a better price, either. If you’re in the market for a new textbook, try negotiating with the campus bookstore or looking for used copies online.

You can also save money on housing by considering options like renting a room in a shared house or apartment from student housing companies instead of living in a dorm.

As you know we have a partner company (Harrington Housing)for this and they are providing the best yet affordable student housing services through 10 cities, so check them out too

Finally, don’t forget to take advantage of student discounts whenever possible. Many businesses offer discounts to students, so always remember to bring your student ID with you.

As a result, you’ll be well on your way to sticking to your budget and achieving financial success in university.

Managing Your Money and Avoiding Debt

One of the biggest challenges of budgeting in university is learning how to manage your money and avoid falling into debt.

While it’s normal to incur some debt during your college years, it’s important to keep it to a minimum and avoid taking on more debt than you can handle.

One way to manage your money is to set up a system for paying your bills on time. This can include setting up automatic payments or creating a calendar to remind you when bills are due.

You should also consider setting up a separate account for your bills and expenses, so you can keep track of where your money is going.

It’s also a good idea to monitor your credit score and take steps to improve it. Your credit score is a measure of your creditworthiness and can affect your ability to get loans or credit cards in the future.

To improve your credit score, pay your bills on time, avoid maxing out your credit cards, and try to keep your balances low.

Part-time Work and Other Income Sources

One of the best ways to manage your finances in university is to bring in additional income through part-time work or other sources. While being a full-time student can be demanding, taking on a part-time job can help you cover your expenses and give you valuable work experience.

There are many options for finding part-time work as a college student, including on-campus jobs, internships, and freelance work. You can also consider starting your own business or selling items online.

In addition to part-time work, there are also other sources of income you can tap into, such as scholarships, grants, and loans. Be sure to research the different options available to you and apply for any that you may be eligible for.

So, you’ll be able to better manage your finances and achieve your financial goals. Plus, the skills and experience you gain from working part-time or starting your own business can be valuable assets in your future career.

Preparing for Life After University

Financial planning for the future: While it’s important to focus on managing your finances in university, it’s also essential to start planning for your financial future. This means thinking about your long-term goals and taking steps to achieve them.

One way to start preparing for your financial future is to create a financial plan. This can include setting goals, such as saving for a down payment on a house or paying off student loans. It can also include developing a budget for your post-university life and finding ways to save and invest your money.

Another way to prepare for your financial future is to start building your credit now. As a college student, you may not have much of a credit history, but by using credit responsibly and paying your bills on time, you can start building a strong credit score. This will make it easier for you to get loans and credit cards in the future.

Finally, it’s a good idea to start learning about different financial products and services, such as investments, insurance, and retirement planning. By educating yourself and taking control of your finances now, you’ll be well-prepared for the financial challenges of post-university life.

Ok, we hope you enjoy reading this blog post. We have lots of useful content in our student tips blog. By following our regular posts, you’ll learn and become a better version of yourself.

See you in the next informative article.